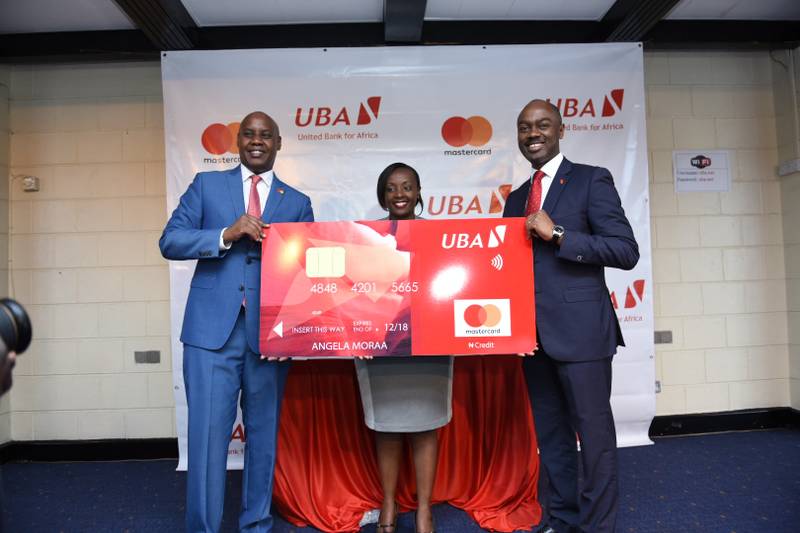

United Bank for Africa Plc (UBA) and Mastercard have jointly introduced a new prepaid card designed to expand access to digital payments for underserved populations across Africa .

According to UBA, the prepaid card eliminates the need for a traditional bank account, targeting young adults, freelancers, gig workers, and low-income earners who have historically struggled to access formal financial services.

According to Punch, the card allows users to easily top up funds, make local and international transactions, and manage expenses with added security and flexibility.

Don’t Miss Out: Nigeria Signs Off Oil Deal with TotalEnergies, Sapetro

This initiative comes at a time when 28.9 million adults in Nigeria remain unbanked, highlighting the urgent demand for digital-first financial tools, particularly among youth and informal sector workers.

Speaking on the launch, Shamsideen Fashola, Group Head of Retail & Digital Banking at UBA, described the card as proof of the bank’s “customer-first approach.” He said:

“We are committed to providing practical solutions that meet the everyday needs of Nigerians, and this card will make payments simpler, safer, and accessible to all”.

Dr. Folasade Femi-Lawal, Mastercard’s Country Manager for West Africa, echoed the sentiment, noting that the collaboration reflects Mastercard’s long-standing commitment to financial inclusion:

“Together with UBA, we are unlocking endless possibilities by connecting individuals across all income levels, demographics, and social strata. This prepaid card empowers Nigerians to participate confidently in the global economy and shape a more inclusive digital future”.

Don’t Miss This: Nigeria, South Africa Strengthen Trade Relations with Focus on Partnerships and Regulation

The prepaid card also doubles as a budgeting and financial planning tool. It provides gig workers with a flexible expense solution, gives parents a secure allowance option for dependents, and offers the unbanked a reliable entry point into the digital financial system.

Backed by Mastercard’s global infrastructure, the card guarantees widespread acceptance and secure transactions worldwide.

By addressing a significant gap in Nigeria’s financial landscape, UBA and Mastercard aim to advance financial inclusion and ensure more people — particularly those left out of the formal banking sector — can access safe and seamless payment solutions.

Image Credit: Nairametrics